CyberPlat® Highlights

Related Links

Benefits of the CyberPlat® system

The largest electronic payment system

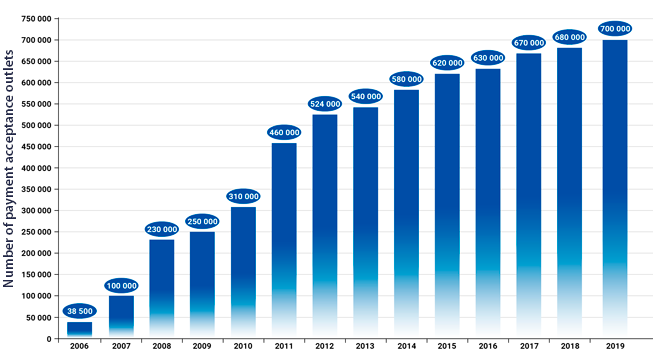

CyberPlat® is a global electronic payment system of transnational nature with the total number of payment acceptance outlets consisting of more than 1 480,000 points-of-sale where more than 630,000 outlets operate in Russia and CIS countries, and others – in the largest cities worldwide.

At present, the total number of payment acceptance outlets of the CyberPlat® system is twenty times the size of the entire Russian banking system (the number of banking institutions with all their branches, offices and even mobile cash registers comprised about 31,400 at the beginning of the 2020).

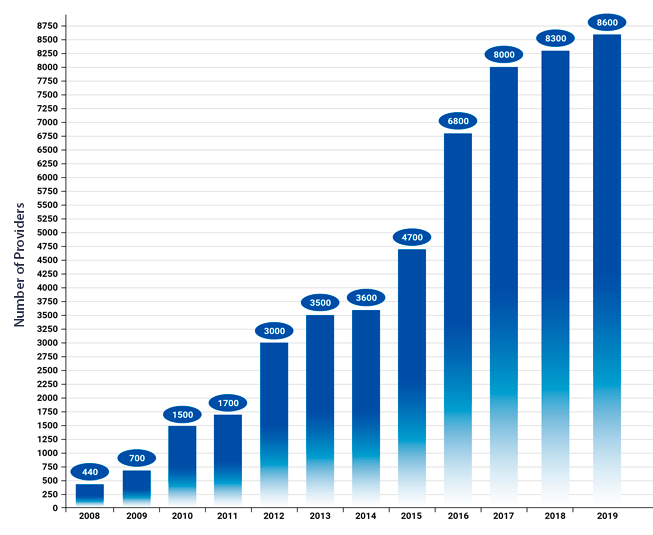

Number of Providers

Number of Outlets

The first electronic payment system in Russia

CyberPlat®, the universal multibanking electronic payment system, was established in 1997 on the basis of the Department of Electronic Commerce at Platina Commercial Bank. It was developed to provide IT-support at effecting non-cash transactions in the e-commerce sector for the whole range of financial services from micropayments to interbank transactions.

In 2000, CyberPlat® was recognized as a separate open joint stock company. Historically, CyberPlat® was the first Russian electronic payment system — the first transaction in favour of GarantPark company was effected on March 18, 1998, whereas the first online payment over the Internet in favour of Beeline, mobile communication operator, was made on August 12, 1998.This event started the payment acceptance market in Russia where CyberPlat® played and continues playing the leading part.

Operational experience since 1998

For fourteen years of operation in the market, the CyberPlat® electronic payment system accumulated a great experience in accepting payments through retail and service networks, as well as through networks of cash-in payment terminals and ATMs. As of the middle of 2016, the system processed payments made in favour of more than 6,800 service providers including mobile and fixed-line communications companies, cable TV, wire-connected and mobile Internet providers, security alarm systems, utility and power supply companies – virtually in all regions of the Russian Federation. The CyberPlat® system also allows to pay for air and railway tickets, replenish bank accounts including card accounts (particularly, regular credit repayments), pay for taxes, fines and dues and fees, make payments to the personal accounts of citizens in the Pension Fund, send money transfers through the majority of popular money transfer systems, and many other things.

Highly qualified personnel

A powerful managerial and engineering potential, human resources, as well as extensive and well-structured business with well-established and developed business contacts in various segments is an important advantage of the CyberPlat® electronic payment system. This is the result of a 20-years operation in the market of retail payments, which in many ways was created through the efforts of specialists and management of the electronic payment system. Today the company employs over 200 specialists with unique knowledge and skills in their field - systems analysts, programmers, experts in finance and banking, in the field of automation of these industries, lawyers and financiers with knowledge of all aspects of the legislative regulation of the retail payment market.

Top management of CyberPlat® is represented by experts with advanced academic degrees and titles.

7 technological base

The CyberPlat® system is based on two processing centres backing each other. The master centre is the centre that is located in Moscow. The connection between the centres and Internet channels are backed up through the networks of independent communications providers. Such system of back-ups combined with advanced cluster architecture ensures high fail safety and independence from the majority of force-major circumstances. CyberPlat® software requirements are very high, so as to guarantee high-quality and high performance of every single module, as well as of the entire system. For the 20 years of its operation, CyberPlat® adjusted and optimized the system, finished and refined its key modules.

Enhanced fault tolerance and performance

CyberPlat® system is capable of processing over 1,400 transactions per second. At the same time, in the peak moments of the CyberPlat® system’s load, inclusive of those moments when, due to technical failures, other payment systems stop operating and the flow of payments through CyberPlat® significantly increases, the maximum load on the system does not does not exceed 110 transactions per second. This means that the system’s productivity capabilities ensure more than a tenfold margin against operation peak levels of the system load.

Today, the capabilities of CyberPlat® considerably outrun most stringent technical requirements of the payment acceptance market in all parameters. The system’s fail safety index is more than 5 times higher than that of the closest competing company.

The reliability of the CyberPlat® system is unrivaled in the market of Russia and CIS countries. Thus, as a result of a complex monitoring of its largest partners in payment acceptance, a leading mobile network operator MTS recognized CyberPlat® as the most reliable processing system in Russia and CIS countries. Such observations are made regularly by an independent expert company with use of effective and proven methods by order of the MTS specialists. CyberPlat® has the highest capacity for fail safety, reliability and speed among all payment systems.

Multiple hardware platforms

A possibility of choosing the payment method and optional use of various devices for effecting payments, depending on the dealers’ capabilities, is a significant achievement of the CyberPlat® electronic payment system.

Payments can be effected through the cashier (teller) using:

- a computer connected to the Internet or even a smart phone (for example, at a dealer company) that performs payments through the CyberPlat® system’s website,

- an automated cash register (for example, at a retail network store) – in this case, interaction with the CyberPlat® system is carried out through the retailer’s server,

- POS-terminals,

- any phone supporting Java,

- other equipment.

Payment acceptance can also be performed without any human (cashier or teller) assistance, i. e. through:

- payment terminals (self-service cash-in kiosk),

- ATMs.

The capabilities of the CyberPlat® electronic payment system are easily integrated in the Internet-Bank-Client systems.

Security and safety

CyberPlat® is the system which operates in the real time mode. Any transaction in the system takes less than 2 seconds. Such unprecedented performance is complimented by absolute security of financial transactions. Each transaction includes up to 16 operations authenticated with an electronic digital signature and performed with use of secure methods of data transmission via Internet channels, including verification of availability of customers’ phone and personal accounts in the billing systems of service providers, identification and authorization of payment acceptance outlets and other operations.

Electronic Digital Signature (EDS) is a property of an electronic document designed to protect it from fraud. EDS allows to identify the holder of the key to the signature and state the absence of garbling of information in the electronic document.

CyberPlat® technology ensures absolute security of financial transactions and minimizes the number of erroneous payments. For the 17 years of its operation, the CyberPlat® system didn’t have a single occurrence of hacking a transaction.

Legality and indisputability of operations, certification

Strict adherence to the existing legislation is a key priority of the CyberPlat® electronic payment system. All organizational and technological procedures within the developed business-model undergo a thorough internal and independent examination - legal and financial – to determine the absence of contradictions with norms of the legislation.

The use of EDS minimizes the risk of fraud and makes the operation of replenishing personal accounts in the operator’s billing indisputable. All payment acceptance transactions effected through the CyberPlat® electronic payment system are performed with use of EDS.

The activity of CyberPlat® is licensed by such state bodies as the Federal Security Service and Federal Service for Supervision in the Sphere of Telecom, Information Technologies and Mass Communications.

The Certificate of KPMG Limited, the leading global auditing company, which performed operational audit of CyberPlat LLC, confirms compliance of CyberPlat’s internal control system with the international standard standards of SAS 70, type I, developed by the American Institute of Certified Public Accountants.

Additionally, CyberPlat CJSC has the Certificate of compliance with the quality management according to the international standard ISO 9001:2008 – a series of international standards which were adopted as national standards in more than 140 countries worldwide.

24x7 technical support

In order to ensure the online continuity of business-processes in the CyberPlat® payment acceptance network, the company established a service of round-the-clock technical support which experts are always ready to give the required advice and provide emergency technical assistance in the following cases:

- failures and problems in configuring the software for payment terminals and cash registers of retail companies;

- when it is necessary to specify the status of payments;

- failures in the work of telecom operators or troubles in the billing of certain providers;

- any other issues related to the breach of processes and procedures for payment acceptance.

Absence of competition with own partners (dealers)

As a processing company, CyberPlat® electronic payment system, unlike other payment systems, never had and still doesn’t have any payment acceptance outlets of its own – neither in the form of a terminal network, nor in the form of a network of retail payment acceptance outlets. An exception is made by the network of 27 payment acceptance terminals designed for checking and testing the software, as well as new payment services and products. Thus, any competition with its own dealers taking place with other payment systems is eliminated. Therefore, dealers working through the CyberPlat® electronic payment system do not experience the following:

- receipt by competitors of information on turnovers of the network and separate payment acceptance outlets which can be used for competition;

- attempts of hostile takeover with the use of obtained information and unethical competition methods (administrative resource, raiding captures, corruption schemes);

- attempts of displacement from the most profitable outlets including the use of such unethical competitions methods as dumping.

For this particular reason, many payment terminal networks, operating through other payment systems, changed over to taking the service from the CyberPlat® company.

Absence of practice of promoting own brand at the cost of partners’ brands

The CyberPlat® electronic payment system provides services primarily as a processing company and does not have payment acceptance outlets of its own. Therefore, unlike other payment systems, CyberPlat® operates in the B2B segment and does not promote its own brand among end-users (payers). In most cases, the competitors of the CyberPlat® electronic payment system are independent players in the retail payment market and, therefore, are highly interested in promoting their own brands in the customer environment, as well as in weakening and displacement of other brands from the market. This causes a direct conflict of interest of such processing companies with their partners — dealers.

Often one of the main requirements when connecting a smaller partner is its unconditional transition to working under the brand which is common for this system. Eventually, it can result in a hostile takeover of the entire business of the partner-company.

In the case of cooperation with the CyberPlat® electronic payment system such problems do not emerge.

Absence of practice of promoting and imposing unnecessary or unprofitable products or services on its partners

The CyberPlat® electronic payment system is maximally interested in the development of its partners’ business, as it does not have payment acceptance outlets of its own. Revenues of the electronic payment system directly depend on its partners’ turnovers - therefore, unlike its competing payment systems, CyberPlat® does not promote or impose on its partners such products and services that might be profitable for the payment system, but unprofitable for its partners. For example, the market is very well acquainted with the model when partners are forced to undertake to maintain at their terminals personal services developed by the payment system solely for its own benefit. Running such services in the partners’ terminal networks not only does not bring them revenues but it reduces the turnovers on principal payments. Partnership with the CyberPlat® electronic payment system eliminates such practice.

Sagereistrasse 33, 8152 Opfikon, Zürich, Switzerland

![]()

- Copyright 1997-2022 CyberPlat